Our profit-share pool

hits new heights.

It’s broken through the $10 Million mark.

IT REALLY PAYS TO HAVE A

PPS MUTUAL POLICY.

Every member is entitled to a share in the profits of the insurance they buy.

And every year since we started the Profit-Share Pool has grown and grown and grown.

Total number of

PPS Mutual Members as

of 30 September 2024:

12,095

Total Profit-Share

Assignment for 2024:

$3,079,837

Total Profit-Share

Account Pool*:

$10,707,862

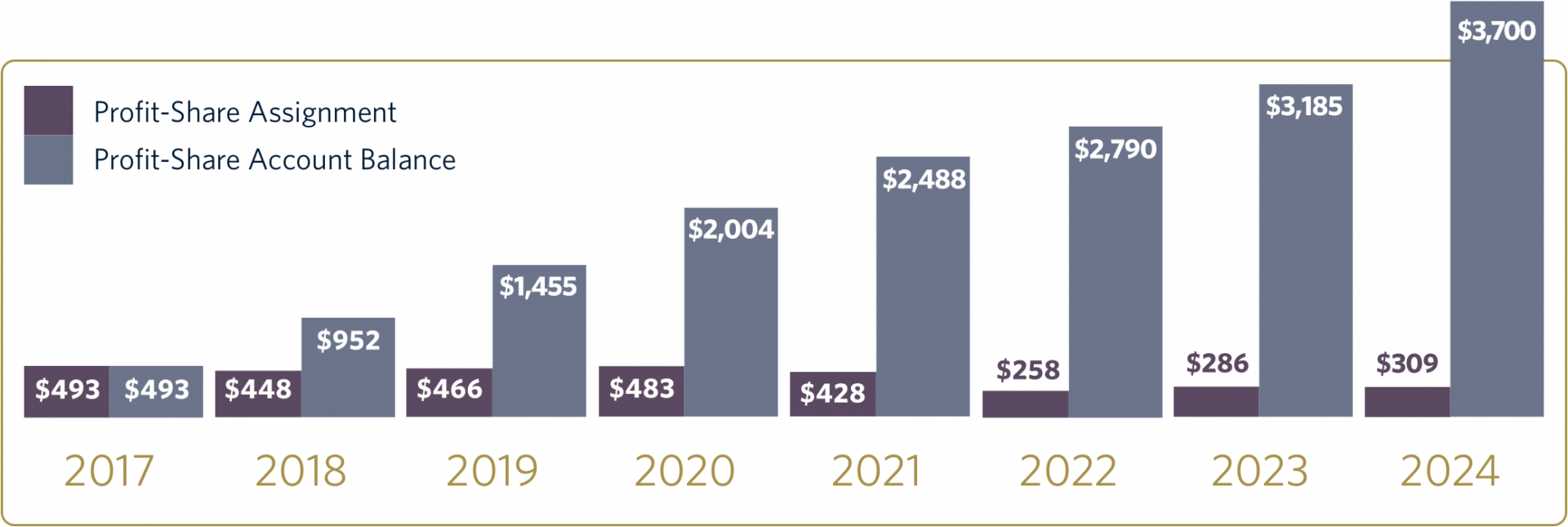

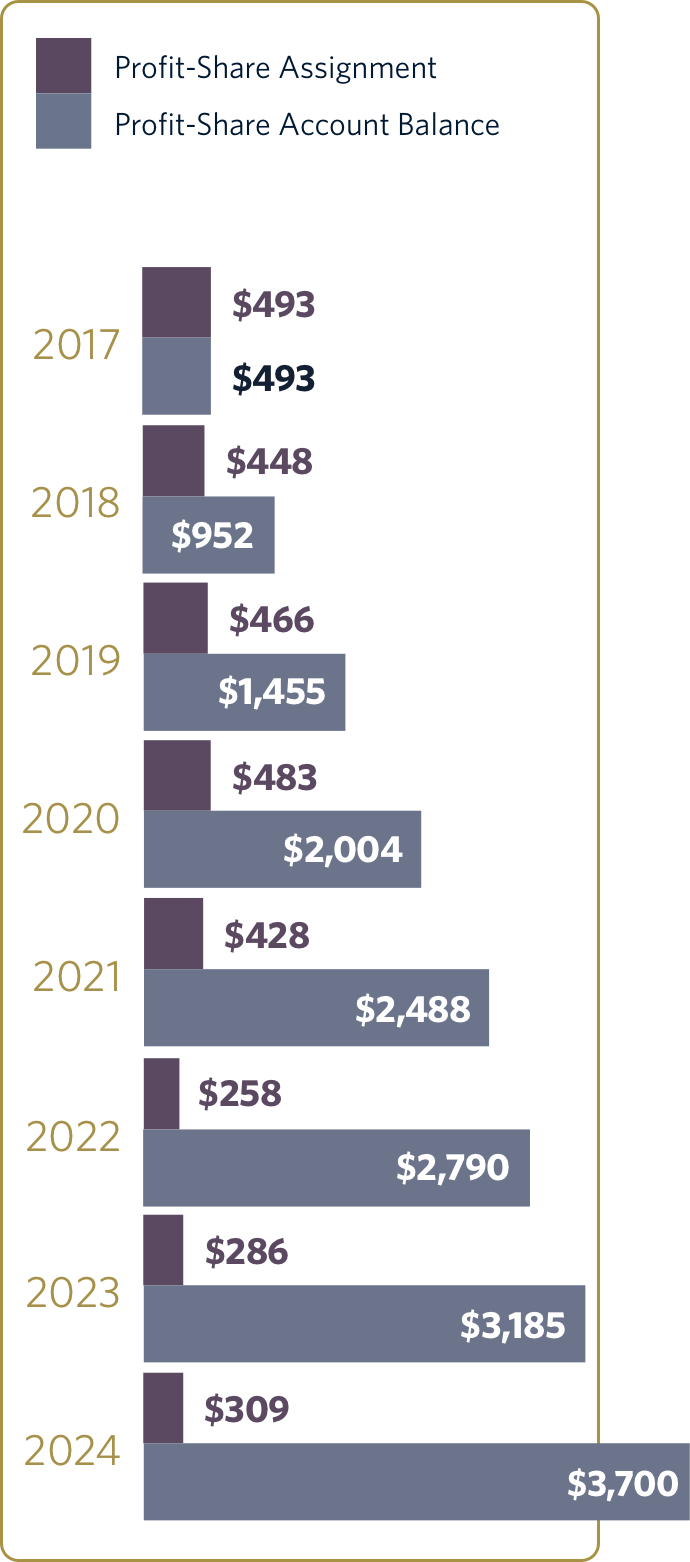

It all stacks up for members

Our Members are enjoying consistent growth in

their personal Profit-Share Accounts.

One Member

has accrued

over $40,000

in Profit-Share

Members have

been rewarded with

a Profit-Share every

year since we

started in 2016

283 Members have

accrued more than

$5,000 in

Profit-Share

74 Members have

accrued more

than $10,000 in

Profit-Share

REWARDS FOR MEMBERS*

Every year since launch Members have been rewarded with Profit-Share

assignments. We assign profit in two ways – as a % of premiums and

as an interest on the Profit-Share Account.

This year the interest rate assigned on Profit-Share Accounts reached

Profit assigned as a % of premiums |

Interest assigned on Profit-Share Account |

|||

| 2017 | 8.0% | + | NA | |

| 2018 | 7.0% | + | 2.0% | |

| 2019 | 7.0% | + | 4.0% | |

| 2020 | 7.0% | + | 4.0% | |

| 2021 | 6.0% | + | 2.75% | |

| 2022 | 3.5% | + | 1.75% | |

| 2023 | 3.5% | + | 2.0% | |

| 2024 | 3.5% | + | 6.5% | |

PROFIT-SHARE FOR MEMBERS

And every year since launch, Profit-Share

Account Balances have reached ever higher levels.

And it all stacks up for advisers

By only providing specialist life insurance for professionals and sharing profits with Members,we’re generating more sustainable, higher value business for our accredited advisers.

24 Advisers

have more than

$100k

in their clients

Profit-Share balances.

One Adviser

firm as over

$1m

in Profit-Share

assignment for their

clients in total.

One Adviser

alone has over

$700k

in their clients Profit-

Share balances.

HIGHER RETENTION RATES

Thanks to our consistent Profit-Share assignments,

once Members join us they very rarely leave.

PPS Mutual

annual lapse rate

4.9%

Industry average

annual lapse rate

15.3%

PPS Mutual and the profit share offering have been a breath of fresh air in the life insurance industry. It provides great peace of mind as an adviser recommending their products that the business is centred around member service/benefits. Every other insurer in the market has the competing interests of delivering shareholder returns and/or client service. These interests aren’t always aligned and we know which comes first in shareholder owned companies. It will be a great pleasure when clients get to the end of their insurance journey being able to return their profit share accounts.

Mark Mullins

Director,

Hood Sweeney Securities Pty Ltd

* Details of the Profit-Share Plan (including limitations on accessing a Profit-Share account) are available in the PDS and you should speak with your adviser about any questions. It is not an investment product and past Profit-Share availability and assignment is not necessarily indicative of future availability and assignment. It’s important to note the balances of the Profit-Share Account are not guaranteed. Profit-Share Assignments may be positive or negative, however the Profit-Share Account balances can never go below zero. Profit-Share Assignment Rate is calculated as a percentage of individual member premiums.