INSIGHT September 25, 2020

An alternative model amidst the great insurer market share chase

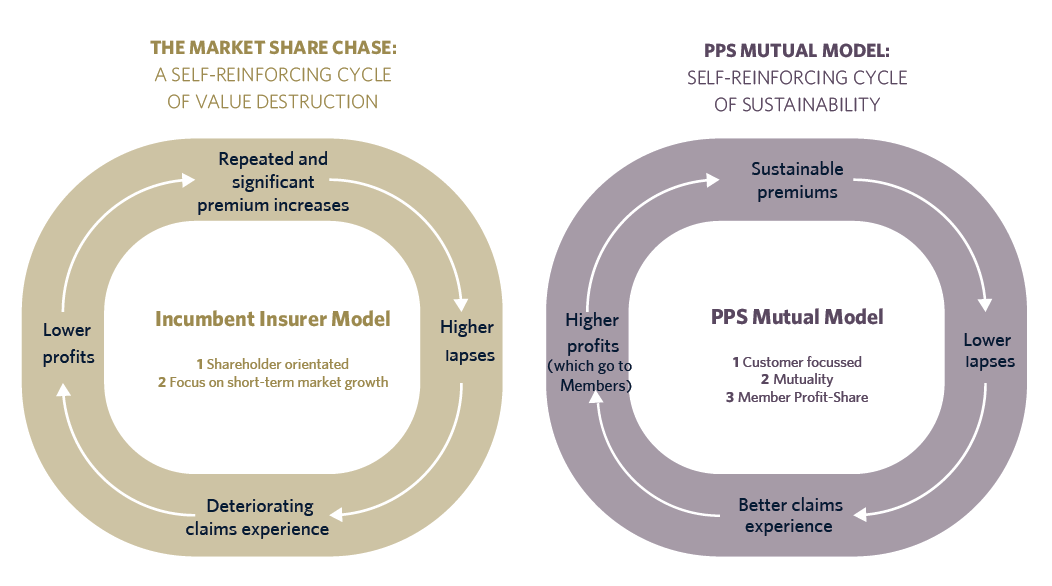

Over the last two decades, the dominant life insurer model in Australia has been shareholder driven with a focus on short-term market growth. It is my belief that this has resulted in a self-reinforcing cycle of value destruction and consequent poor outcomes for consumers.

This is a bold statement, which I do not make lightly. However, when the retail life insurance industry has been faced with $800 million worth of losses in the 12 months to the end of June 2020[1], we must seriously question the sustainability of the underlying industry dynamics. This problem is even larger when you take into account $600 million in losses for group insurance.

For contextual purposes, it is important to ask the age-old chicken or egg question- did the financial losses create the market share chase, or was it the reverse?

In order to begin to answer this question, we first need to understand what brought on the great market share chase.

The birth of the chase can be pinpointed back to the 1990’s with the demutualisation of Australian life insurers. This demutualisation created a race for market share as vertically integrated or bancassurance models became focused on in-house product sales rather than consumer best interest.

A cycle of value destruction emerged as life insurers, now owned by banks, were faced with return on equity pressure, maximising shareholder dividends and short-term sales targets to meet the next quarterly return. The valuations of wealth management businesses were also heavily based on their ability to ‘cross-sell’ products.

These practices and behaviours simply became normalised across the retail life insurance sector. To summarise: the long-term best interest of insured customers had been supplanted by the short-term interests of shareholders.

The self-reinforcing cycle of value destruction

The cycle of value destruction has at its heart certain core attributes: soft underwriting, special underwriting deals created for special customers of special financial advisers, takeover terms and more recently front-loaded discounts.

This has resulted in negative implications for the industry such as repeated and significant premium increases, higher lapses, a deteriorating claims experience and lower profits.

The cycle is evident in the severe financial losses and invariably higher premium rates we have witnessed to date. It is also evident in the concurrent policy lapse rates that the industry is experiencing. The latest NMG stats up to June 2020 show lapse rates for retail life insurers at 15 per cent across the industry[2].

In contrast, lower lapses have a double benefit to insurer profitability. Not only does it allow for more premiums receivable to cover the high new business costs, but it also leads to lower claims as evidenced by the recent claims investigations into income protection experience that showed level premium business (that has low lapses) has 12 cent to 15 per cent better claims experience than stepped premium business (high lapses). This is caused by the healthy lives lapsing (to move to better or cheaper covers) and so leaving a poorer mix of lives.

The structural issues discussed above have also led to a decline in the quality of insurer risk pools. It takes just a relatively small number of new customers allowed through the ‘gates’ (who otherwise wouldn’t have been insured) to have a dramatic impact on the quality of your risk pool. Once the quality of a pool begins to deteriorate it can rapidly lead to a steep and irreversible decline.

Lack of sustainability

The focus on short-term growth and top-line performance has come at the expense of long-term profitability and sustainability.

This is evidenced in APRA’s Sustainability measures for individual disability income insurance review. APRA said that three of the four main risk product groups available in Australia reported a loss for the March 2020 quarter. Worst among these three products, primarily driven by an adverse claims experience, was Individual Disability Income Insurance or DII.

Income Protection is currently unsustainable as clients either face significant premium increases or insurers continually incur losses that would ultimately lead to a significant reduction in the availability of income protection cover for consumers. Neither of these outcomes seem acceptable or in line with consumer best interest.

APRA focused in its review on the increasingly generous product terms offered by insurers and a ‘first mover reluctance’ to wind back these terms, despite their unsustainability, for fear of losing business. This is undoubtedly a valid assessment, particularly where product design issues provide a disincentive for the claimant to return to work.

While generous product terms could be another facet of the market share chase, it could also be argued that many product terms now under the microscope are viable so long as they are priced and underwritten properly. This could apply particularly to certain market segments such as the self-employed and professionals. It could be a travesty if APRA takes a sledgehammer to ‘crack open’ the sustainability nut, only to find that the other aspects of the market share chase continue to undermine product sustainability, resulting ultimately in continued poor outcomes for consumers and advisers.

An alternative mutual model

I believe the retail insurance industry needs an antithesis of the incumbent insurer model. The mutual model can address the inadequacies inherent in the current retail insurance industry mode of practice.

The industry needs to focus on competitive and sustainable product design, prudent underwriting and prioritise a longer-term focus.

For our part, PPS Mutual differentiates itself proudly as a mutual insurance provider focussed on delivering long term rewards to our Members. Our philosophy is to design products specifically for our professional Members, protect our existing risk pool by prudently underwriting prospective Members, pay claims (like other insurers) and ultimately distribute profits back to policyholder Members (unlike the incumbent insurers where profits are for the benefit of shareholders). All of this should result in superior client loyalty in the form of higher customer retention rates.

The success of the PPS Mutual model is evident in our lapse rates which currently sit at 4 per cent compared with the industry average of 15 per cent[3]. The relativities in lapse rates to the industry are similar in South Africa for our associate company PPS South Africa who has been around for over 75 years. Lower lapses in turn lead to better claims experience and higher profits, which in our mutual model are awarded to insured members, rather than shareholders (as part of our profit-share system).

If a Member feels that their cover is at least as good as anything else that exists in the market, but instead of the profits going to shareholders, they are coming back to them as owner Members, why would they go anywhere else? So we come full circle as higher profits in turn result in lower lapses. We like to think of this as a self-reinforcing cycle of sustainability and success.

Our long term ethos is also found in our recognition of the need to protect our existing risk pool. We feel strongly that our existing Members are just as important as new Members, therefore we advocate for equity amongst Members.

There has never been a more important time to reassess past dynamics of the sector, and work towards building a strong and sustainable insurance industry for all Australians.

Let’s end the market share chase and instead focus our efforts on a true alignment of interests and incentives with the actual life insured.

[1] APRA Quarterly Life Insurance Performance Statistics

[2] “NMG – Retail Advice Channel Risk Distribution Monitor Q2 2020”

[3] “NMG – Retail Advice Channel Risk Distribution Monitor Q2 2020”