INSIGHT October 30, 2020

Dispelling misconceptions around mental health and insurance

As October is mental health awareness month, we thought it was timely to discuss why life insurance is a valid and important choice for people who may suffer from the often-debilitating impact of mental health problems and dispel some commonly misunderstood myths about the benefits that personal insurance hold for mental health sufferers. It is also worth exploring the pragmatic underwriting approach that PPS Mutual take to pre-existing mental health conditions.

The 2020 year will of course be remembered for the impact of the global COVID-19 pandemic. Physical and mental stress has taken a huge toll on all, with large numbers of Australians suffering not only in terms of their health, but also their financial and emotional wellbeing. Key drivers in mental health deterioration have come from the change in people’s usual activities, routines or livelihoods. This includes enforced government lockdowns, quarantines, companies requesting employees to work from home or workers having to go part-time, or in the worst cases being stood down temporarily or permanently.

Each of these factors have contributed to increased levels of anxiety, loneliness and depression.

Concerns around access to essential services and continuity of treatment for people with developing or existing mental health conditions are also now a major concern, along with the mental health and wellbeing of essential frontline workers. There are some holistic steps people can take to supporting their mental health during this time, such as cutting back on alcohol, getting active and seeking appropriate support. As a positive response the federal government has provided additional support to all Australians by boosting the number of subsidised psychological therapy sessions available as part of its response to COVID-19.

But how can insurance help to offer peace of mind?

If a stressful time is anticipated, such as the March 2021 cessation of JobKeeper potentially resulting in unemployment, a proactive approach to ensuring mechanisms are in place when these stressful triggers occur, such as accessing subsidised psychological therapy sessions, increasing physical exercise and reducing alcohol & other forms of stimulants intake, can make a substantial difference to the impact of stressful events on mental health and therefore the impact on a future life insurance application.

This very real increase in mental health triggers means that it is of the upmost importance for people to be proactive in protecting their mental wellbeing. Having personal insurance in place can help reduce anxiety around financial security if a sickness or injury, trauma or unforeseen tragedy occurs.

If someone already suffers with mental health illness, why should they still purchase personal life insurance?

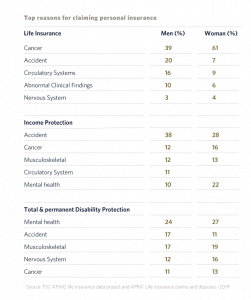

Recent evidence from the 2019 FSC-KPMG life insurance data project study (see table below) shows that a person is far more likely to claim for injury or illness not associated with mental health illness, than they are for a mental health claim. Therefore, the significant benefits of personal insurance should not be cast aside if an applicant has a history of mental illness. Even if an applicant has sought treatment or counselling for mental health concerns (and potentially has a mental health exclusion), the customer can still potentially be covered for all the various types of insurance i.e. life, total and permanent disability, critical illness and income protection.

The data also shows that mental health claims for Life and Income Protection insurance are significantly outweighed by claims due to cancer, accident, heart attack/stroke and musculoskeletal conditions. The study found only a disproportionate representation of mental health claims for Total & Permanent Insurance.

The reality is, that it is far more likely for a claim to be lodged for an illness or injury outside of a mental health condition, therefore the benefits of the personal insurance are not necessarily negated by a potential mental health exclusion.

It is important that advisers communicate this to clients who have experienced mental health issues, so as they are not dissuaded from looking into personal insurance.

What is PPS Mutual’s approach to mental health?

Since launching in 2016, PPS Mutual has always taken an individualised, holistic approach in our underwriting assessments. As a mutual insurer, we have a greater interest and capacity to invest the time in undertaking individualised assessments to obtain a balanced and holistic view of an applicant’s health. This approach would be a greater challenge to a larger insurer who in order to manage their larger book would need to adopt a more standardised approach to its underwriting assessments.

All underwriting and claims assessors are trained to provide an empathic approach to the assessment of an application or a claim.

In practical terms, PPS Mutual will review applicants on a case by case basis and take a pragmatic approach, which in the case of prior mental health issues would be to understand the impact of the mental health issues on the person; how they are managing; and if the applicant sought any proactive measures prior to symptoms occurring or a diagnosis to reduce levels of anxiety and stress. The assessment therefore will balance both positive and negative factors needed for consideration of cover, which benefits will be offered and under what conditions. As our primary goal is to provide a best outcome for the client at all stages, we always recommend providing transparent and complete information when speaking with an insurer.

The long- term implications in obtaining personal insurance for a client seeking help from his or her GP concerning mental health, will always depend on how each individual insurer views the ‘real world’. PPS Mutual understands and accepts that there are unprecedented levels of stress due to the COVID-19 pandemic and we would naturally take that into consideration in future applications It will not necessarily result in an automatic penalty to your underwriting assessment.

PPS Mutual has taken a leadership position in the industry with our underwriting approach. The approach that we have adopted is currently under consideration to be mandated to Life Insurers through the Life Insurance Code of Practice. Mandating this philosophy will be of significant benefit to the industry. Putting it into practice, however, will pose a greater challenge to the larger insurers whose operations are generally set up for a standard ‘cookie-cutter’ assessment.

If you would like to know more about PPS Mutual or to become a PPS Mutual Accredited Adviser, please get in touch with your local State Manager.

If you or someone you care about needs support, please contact:

Lifeline 13 11 14

Suicide Call Back Service 1300 659 467

MensLine Australia 1300 78 99 78

Beyond Blue 1300 22 4636