INSIGHT November 05, 2020

UK regulator acts on front-loaded discounts – will Australia follow suit?

It is with great interest that we have been watching the outcome of a market study undertaken by the UK’s financial regulator, the Financial Conduct Authority (FCA), into the so-called ‘loyalty penalty’ applied by some home and motor insurers when it comes to renewal pricing.

In a practice known as ‘price walking’ the FCA has found that it is common for personal insurers to offer attractive pricing to new customers, before applying gradual increases to their renewals in the following years, despite no change to their risk profile.

To address the situation, which the regulator has declared “is not working well for consumers”, the FCA is consulting with the industry about introducing a measure to ensure that when a customer renews, they cannot be charged more than a new customer buying through the same sales channel.

It’s a situation that mirrors practices in the Australian life insurance industry, where a research paper commissioned earlier this year by PPS Mutual and undertaken by Rice Warner found that while up-front – or front-loaded – discounts on new life insurance policies makes them more affordable initially, over the medium to long term they are actually more costly.

In one example, the research found that customers of an insurer that offers a 25% up-front discount could face premium increases of 50% in the second year if age-based increases and indexation are taken into consideration.

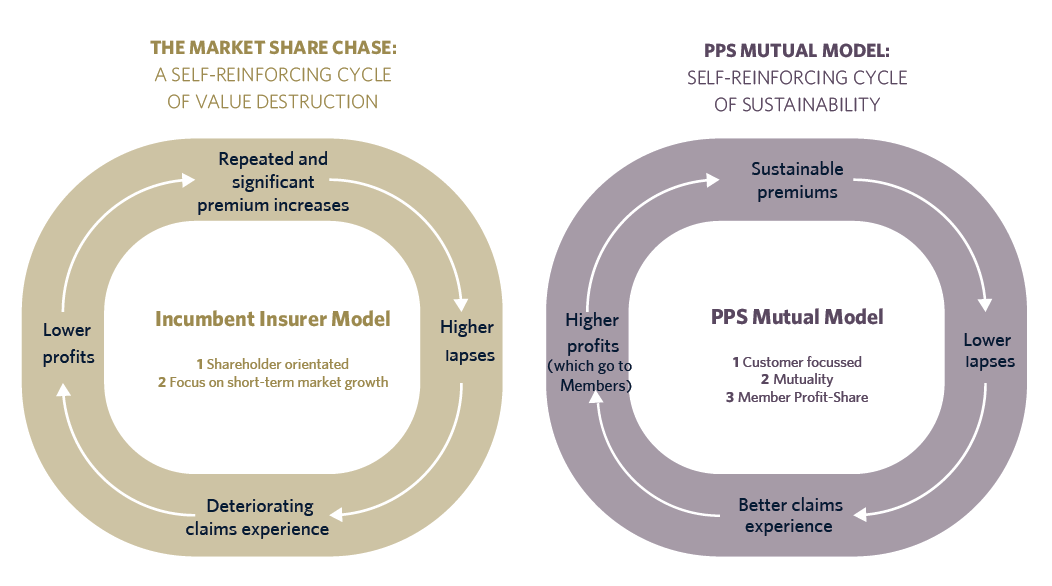

This vicious cycle of using first year discounts as loss-leaders to attract new customers only to have them take their business elsewhere when their premiums begin to increase leads to the circular – and unsustainable – situation of having to continue discounting to attract additional new customers to replace those that leave.

But as the short-term quest to satisfy shareholders and increase market share continues unabated, traditional life insurers so far appear unwilling to abandon this practice, despite recording losses of $800 million and policy lapse rates of about 15% in the year ended 30 June 2020.

By contrast, at PPS Mutual, we take a long-term view, valuing customer loyalty and prioritising customer retention, and we question a business model that places new customers ahead of loyal ones.

As a mutual with no shareholders, we exist solely for the benefit of our Members and do not offer front-loaded discounts, instead returning profits to our Members through an annual Profit-Share arrangement. As a result, our lapse rate runs at roughly a quarter of the industry standard, allowing us to increase profits and meaning our current customers are not forced to shoulder the costs of us acquiring new customers.

It is financial advisers who bear the brunt of customer dissatisfaction when they learn of steep premium increases at renewal, so it is not surprising to find that the majority are not in favour of front-loaded discounts. A recent poll of advisers in Riskinfo asked respondents if they were willing to advise their clients to consider taking out a new life insurance policy that offered a front-loaded premium discount. Sixty-two percent of advisers said “No”, 26% said “It depends” and 11% said “Yes”.

Aside from facing the dissatisfaction of their customers, advisers are under increasing regulatory pressure to ensure they are acting in the best interests of their customers, and it could be argued that advising a customer to take out a life insurance policy with a front-loaded discount where the premium then increases substantially in the following years may not meet that best interest test. This would be even more pronounced if a customer had experienced a change in their health circumstances in the intervening period that prevented them from taking out a new policy with another life insurance provider.

Whether this mounting adviser pressure will force the industry’s hand to act on front-loaded discounts is something that remains to be seen.

In the case where an industry fails to act, the Australian Prudential Regulation Authority (APRA) has shown that it is willing to intervene, as witnessed in its recent decision to step in and address flaws in pricing and product design in the Australian income protection (IP) insurance market.

With mounting losses now reaching $4.8 billion over the past five years, APRA put life insurers on notice last year over concerns about the ongoing viability of the IP insurance market. More recently, the regulator announced it would impose an additional capital charge on insurers from October 1 to force the industry to reform, with further measures aimed at addressing riskier products scheduled to begin in October 2021.

When it comes to the future of front-loaded discounts in the Australian life insurance market, the question that remains is not whether addressing this practice will benefit customers. Instead, it is whether the life insurance market has the will to implement the required changes itself, or whether it will take regulatory intervention – such as that which has occurred in the UK – to bring about a better outcome for Australian customers.