NEWS March 29, 2023

Adviser Door Open to More Mutuals – Poll

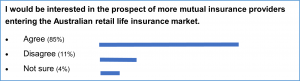

As we go to print, a significant 85% of Riskinfo readers say they’re open to the prospect of more mutual life insurance providers having access to the Australian retail life insurance sector, while only (11%) say they’re not.

For those who voted that they’re open to the prospect of more mutual insurance providers, each person will have their own set of experiences which will have informed their vote. These may relate to recent positive experiences in dealing with what is presently Australia’s sole mutual insurance business, PPS Mutual, or they may have been been informed by positive experiences dealing with the mutuals of the past. They may also have based their vote on what they perceive to be the potential for a sharper focus on what’s in the insured life’s best interests as a member of a mutual insurance structure, rather than as a policy holder in a company owned by shareholders.

Whatever the reason behind the voting sentiment in this poll, it appears reasonably evident that any new mutual insurance proposition launched into the Australian retail market would be given the opportunity to state their case to the adviser community.

Do you agree? Or do you think we’ve mis-read this outcome? We’d welcome your thoughts as our poll remains open for another week…